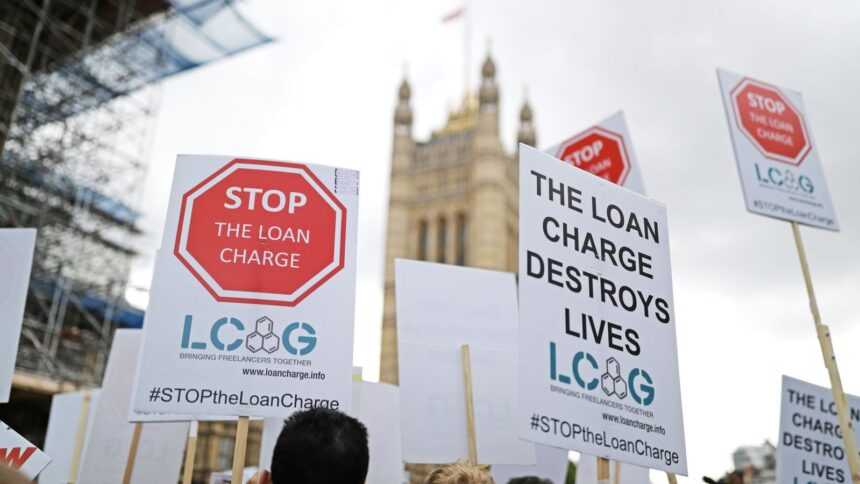

After the Treasury Committee wrote to the tax office to obtain details on its approach to contractor loan schemes, the Loan Charge Action Group (LCAG) took offense.

Tens of thousands of workers who enrolled in these programs are now facing financially ruinous bills for taxes on their salaries that their employers should have paid. These programs were incorrectly and widely marketed by companies as HMRC compliant in the early 2000s.

“Little more than a tick box exercise triggered by all of the recent coverage of the Loan Charge,” campaigners claimed of the Treasury Committee letter.

“It is frustrating that the Treasury select committee has merely written to HMRC instead of holding a full select committee inquiry to hear evidence from those facing the Loan Charge and tax sector professionals,” said Steve Packham, a spokesman for the , to News.

HMRC was also charged with providing “misleading and partial responses” by him.