Her support has worn thin, though, after four years of price increases, and each time she goes grocery shopping, she is reminded of how things have gotten worse.

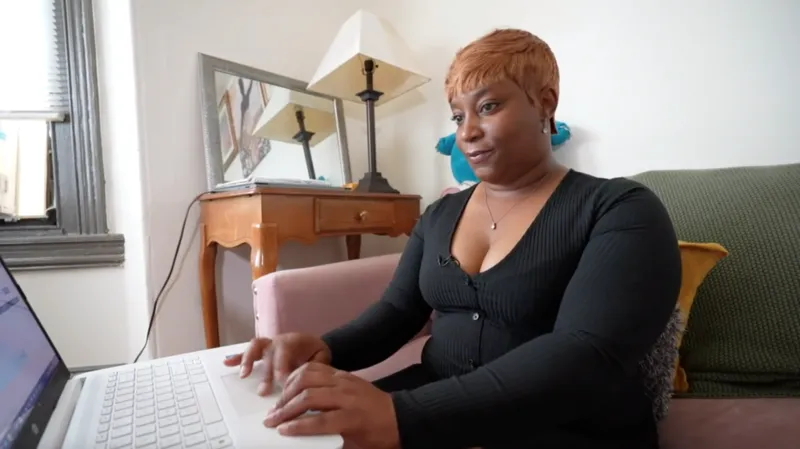

Ms. Ellis has two jobs: one part-time and one full-time as a nurse’s assistant.

But she must cut costs. She has changed retailers, eschewed name brands like Stroehmann bread and Dove soap, and she has all but bid farewell to her favorite Chick-fil-A sandwich.

Nevertheless, Ms. Ellis has occasionally resorted to hazardous payday loans—short-term, high-interest loans—in an effort to cope with the 25% increase in grocery costs since Mr. Biden took office.

She states, “I never asked for a payday loan or anything like that, and I didn’t have any debt or credit cards before inflation. However, I had to do all those things because of inflation, which forced me to drastically lower my standard of living.”

The historic 20% increase in living expenses that followed the epidemic has been surpassed by the spike in supermarket prices, which is placing pressure on people nationwide and stoking political and economic unrest.

Ms. Ellis, who resides in the Norristown area of Philadelphia, declares herself to be a Democrat. “I enjoy giving them my vote. However, Democrats are currently whispering while Republicans are shouting loudly.”