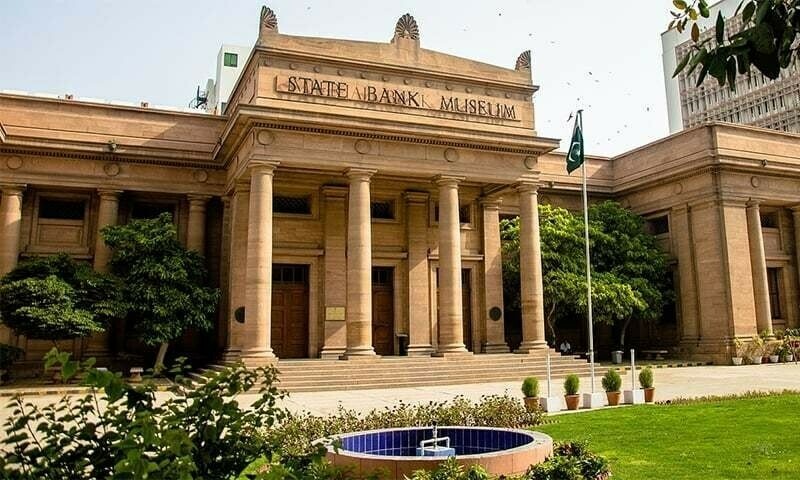

The central bank stated in its Mid-Year Performance Review on the Banking Sector for 2024, which was made public on Wednesday, that the government continued to be the biggest borrower of banking funds, which caused the earnings of the whole banking sector to double in CY23.

In FY25, the government intends to borrow more than Rs9.3 trillion from banks, mostly to pay down its domestic debt. The analysis looks at the domestic banking industry’s stability and performance from January to June. The performance of the financial markets and the findings of the Systemic Risk Survey (SRS) are also briefly covered.

The State Bank reported that although long-term financing to SMEs showed some resurgence, advances registered a limited expansion as a result of the private sector’s net retirements.