Chinese AI chip startup Shanghai Biren Technology has raised HK$5.58 billion, or about $716.85 million, in its Hong Kong initial public offering.

The company set the offer price at HK$19.60 per share, the top of the marketed range. It sold 284.8 million shares through the IPO.

Strong Investor Demand

Investor interest was extremely high. Institutional investors demanded nearly 26 times the shares on offer. Meanwhile, the retail portion of the IPO was oversubscribed roughly 2,348 times.

Biren’s shares are expected to debut on Friday.

Growing Chinese AI Chip Industry

Biren follows other successful Chinese AI chip IPOs, including Moore Threads and MetaX. China is pushing to develop domestic alternatives to U.S. semiconductors. This comes amid strict export limits from Washington on advanced chips.

Founded in 2019, Biren’s co-founders include Zhang Wen, former president of AI face-recognition firm SenseTime, and Jiao Guofang, who previously worked at Qualcomm and Huawei.

Notable Products and Market Potential

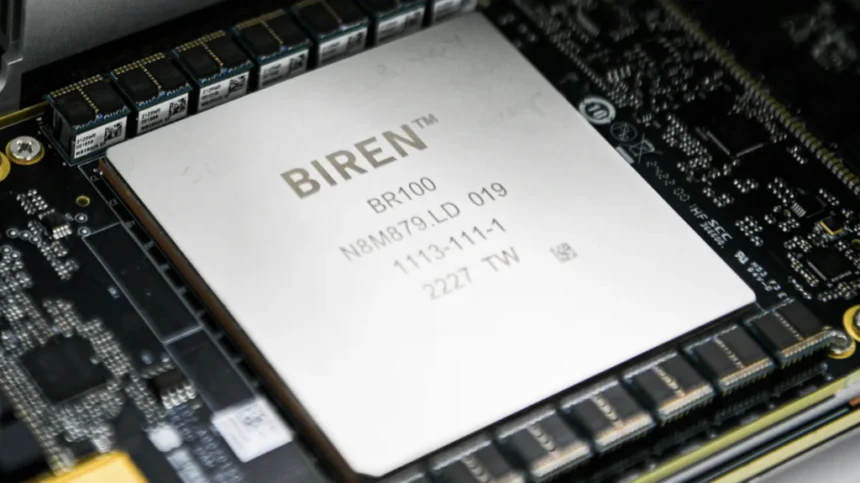

Biren first gained attention in 2022 with its BR100 chip. The company claims it can rival the performance of Nvidia’s advanced H100 AI processor.

This IPO comes during Hong Kong’s strongest year for listings since 2021. So far in 2025, Hong Kong has raised $36.5 billion from 114 new listings, more than triple the $11.3 billion raised in 2024.

Strategic Importance

Biren’s listing highlights China’s focus on building domestic AI chip capabilities. With strong investor demand and innovative products, the company is poised to play a key role in the local semiconductor industry.