Crypto legislation moves forward despite past banking failures

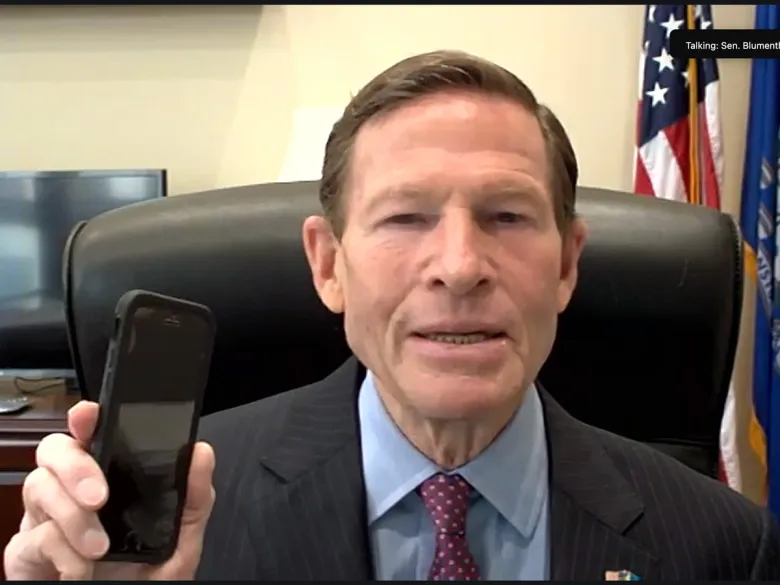

Senator Richard Blumenthal is sounding the alarm as the Senate Banking Committee prepares to move new crypto legislation. He argues that Congress is rushing to satisfy powerful crypto interests while ignoring clear warning signs from recent banking collapses.

Blumenthal points to a detailed Senate investigation released last year that examined the failures of Silicon Valley Bank, Signature Bank, and First Republic Bank. These banks were given clean audit reports shortly before collapsing, costing customers and investors billions. According to the findings, deep ties to tech and crypto money played a major role in how fast these institutions unraveled.

How crypto turned innovation into contagion

During the crypto and venture capital boom, these banks saw massive inflows of deposits. But when crypto markets turned, that money exited just as quickly. The collapse of FTX, falling Bitcoin prices, and the shutdown of Silvergate Bank triggered panic across the sector.

As confidence disappeared, depositors rushed to withdraw funds. Federal authorities were forced to step in with roughly 340 billion dollars to stop wider contagion. Even with intervention, more than 54 billion dollars in stocks and bonds became worthless, including heavy losses for pension funds.

Blumenthal warns that without stronger safeguards, the same cycle could repeat.

Stablecoins and rising systemic risk

One of the senator’s biggest concerns is the rise of stablecoins. Crypto firms are pushing these so called digital dollars as alternatives to bank accounts, often promising yield similar to interest. However, unlike traditional deposits, stablecoins do not have the same protections that saved many depositors during the 2023 bank failures.

Signature Bank is cited as a clear example of crypto risk. Heavy exposure to crypto related deposits left it vulnerable when confidence collapsed after FTX. Auditors repeatedly failed to flag these dangers, highlighting what Blumenthal calls the opacity of crypto markets.

Lessons Congress should not ignore

Since the passage of the GENIUS Act, several major stablecoins have already lost their currency peg, wiping out hundreds of millions of dollars. The stablecoin market is now valued around 300 billion dollars and could grow much larger in the coming years.

Blumenthal argues that history shows what happens when profits stay private and losses fall on the public. He urges lawmakers to slow down, strengthen oversight, and keep risky crypto activity from becoming deeply embedded in the banking system.