The Pakistan Stock Exchange (PSX) reversed course on Tuesday after a brutal two-day sell-off that pushed the benchmark index below 60,000, as angry investors took the post-vote political mayhem in stride and binged on bargains in the second half, according to dealers.

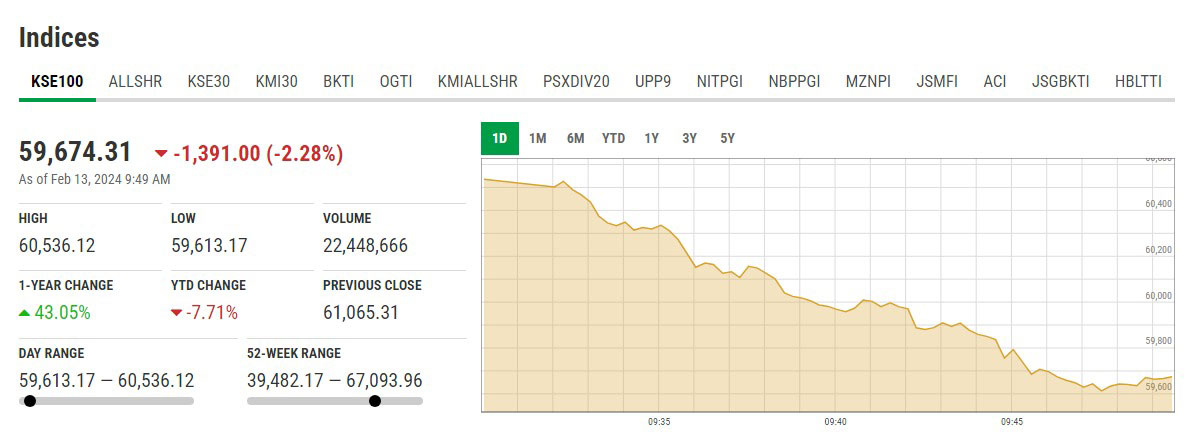

In the first 15 minutes after the opening bell, PSX’s flagship KSE-100 index fell below the critical 60,000 threshold, indicating low investor confidence amid continuous political turmoil.

At its lowest point, the benchmark KSE-100 Shares Index hit 59,613.31, experiencing a decline of 1,391 points or 2.28% in intraday trading compared to the previous day’s close of 61,065 points.

The day began shakily, with OGDC and PPL plummeting on IMF tariff concerns, pushing the index down more than 2%. Uncertainty about government formation exacerbated the selling pressure.

As soon as the script changed, investors pounced on the bruised equities at bargain prices. The index recovered, gaining roughly 1,600 points from its intraday low and ended modestly higher.

The index rose by as much as 1,614 points, or 2.7%, from its intraday low, finishing at 61,226.93, up 161.61 points, or 0.26%, from the previous session’s close.

Analysts attribute the variations to uncertainty surrounding the establishment of a new administration, noting that the KSE-100’s previous bounce following political instability demonstrates market actors’ natural agility.This adaptability is critical as Pakistan’s political and economic landscape is in flux, while investors are closely monitoring developments and are prepared to alter their strategies to capitalize on possibilities while minimizing risks in this ever-changing climate.

The market was highly volatile, with an intraday low of 1,452.14 points and an intraday high of 589.34.

The KSE-100 index traded 253.487 million shares today, following two dismal sessions that resulted in a 3,079-point fall. However, a somewhat positive MSCI evaluation prompted a rally, with 55 index constituents closing higher and 33 closing down.