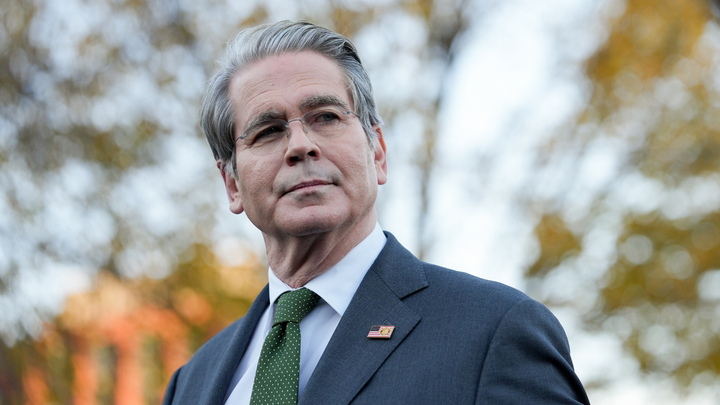

Scott Bessent Minnesota Fraud Warning: Billions Lost Through Abuse

Scott Bessent says the Minnesota fraud case shows how criminals exploited weak oversight and public trust. The Scott Bessent Minnesota fraud investigation focuses on billions in taxpayer funds that were meant to help children, disabled seniors, and students with special needs but were instead stolen by organized networks.

He argues that years of inaction allowed the fraud to grow unchecked.

Federal Teams Track Scott Bessent Minnesota Fraud Money Trails

During a recent visit to Minneapolis, Bessent met with investigators, prosecutors, lawmakers, and community leaders. He said frustration was widespread among officials who have fought the Minnesota fraud scheme for years.

The Treasury Department is now tracing where the money went. The Scott Bessent Minnesota fraud probe includes transfers sent overseas, including to Somalia. Officials believe criminals used money service businesses to move funds quietly and avoid banking safeguards. Some transfers may have reached extremist groups.

Banks and Financial Firms Face Scrutiny

Treasury agencies are reviewing whether financial institutions followed anti money laundering laws. FinCEN and the IRS are checking compliance with the Bank Secrecy Act.

Bessent says banks that ignored warning signs will face consequences. He also confirmed that whistleblowers who help expose the Minnesota fraud network can receive rewards.

New Rules Aim to Block Fraud at the Source

To stop future abuse, FinCEN issued a Geographic Targeting Order for Hennepin and Ramsey Counties. Banks must now report extra details on international transfers over $3,000.

Local law enforcement has received training to use this data. Officials believe this step will speed up prosecutions and help recover stolen funds.

Welfare Funds and Overseas Transfers Raise Alarms

Bessent highlighted cases where people receiving government benefits still sent money abroad. He says this practice shifts the financial burden onto taxpayers.

Under the new rules, financial institutions must mark whether wired funds come from benefit programs. Treasury will use this data to measure how widespread the abuse is.

A Nationwide Expansion of the Minnesota Model

Bessent warned that Minnesota is not alone. He believes similar fraud schemes operate in states with weak controls. Federal estimates suggest fraud costs the government more than $500 billion each year.

President Donald Trump has ordered the Justice Department to expand the Minnesota fraud crackdown led by Bessent nationwide model nationwide. A new unit will focus only on fraud cases.

Bessent says the government will recover stolen funds and prosecute offenders across the country.