Nvidia has stunned Wall Street with a record-breaking $57 billion in revenue for Q3, signaling unstoppable growth in AI computing. The chipmaker’s GAAP net income surged 65% year-over-year to $32 billion, surpassing analyst forecasts for both sales and profits.

Driving the growth, Nvidia’s data center segment generated a record $51.2 billion, up 25% from last quarter and 66% from last year. Gaming contributed $4.2 billion, while professional visualization and automotive together added $1.6 billion.

CFO Colette Kress highlighted that the surge is fueled by advances in AI, powerful computing models, and the rapid adoption of agentic AI technologies. Nvidia is also expanding AI infrastructure globally, with projects totaling 5 million GPUs for cloud providers, enterprises, and supercomputing centers.

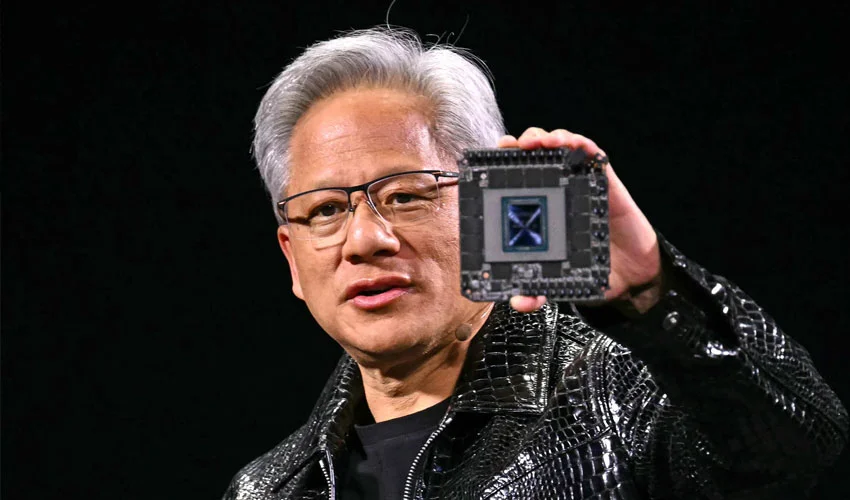

The Blackwell Ultra GPU has emerged as a major revenue driver, with strong demand for both the latest and previous Blackwell models. CEO Jensen Huang said, “Blackwell sales are off the charts, and cloud GPUs are sold out,” noting exponential growth in AI training and inference.

However, the company faced challenges with the H20 data center GPU, which shipped only 50 million units due to geopolitical restrictions limiting sales in China. Kress confirmed Nvidia is working with authorities to maintain global competitiveness.

Looking ahead, Nvidia forecasts $65 billion in Q4 revenue, reinforcing its leadership in the AI revolution. Huang dismissed concerns of an AI bubble, stating, “From our vantage point, AI is just getting started.”

#Nvidia #AIGrowth #BlackwellGPU #DataCenter #TechStocks #AIComputing #Semiconductors