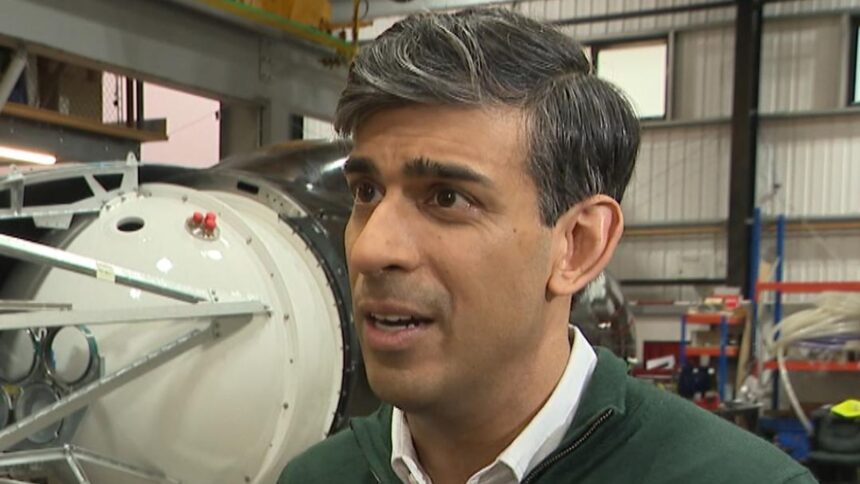

According to tax records made public by Rishi Sunak, his income increased from around £2 million to £2.2 million.

While parliament was in recess on Friday afternoon, a summary of the prime minister’s financial matters was made available to the public.

According to the document, he paid £508,308 in taxes during the 2022–2023 fiscal year, which is around £75,000 more than he paid the year before.

Mr. Sunak received dividends and other income of £293,407 in addition to roughly £1.8 million in capital gains, which increased from £1.6 million in 2021/22.

The summary states that every investment income and capital gain originated from a US-based investment fund that was listed as a blind trust.

In addition, he received £139,477 from his ministerial and legislative positions.

Despite earning millions more in revenue, he paid the same effective tax rate as a teacher, as his detractors pointed out.

This is so because the majority of his income was paid in capital gains, which are subject to a lower tax rate than income.

According to the paper, the Tory leader’s overall income increased from about £2 million to £2.2 million, a 13% increase from the previous year.

That brings his earnings over the previous four years to about £7 million.

Approximately 23% of his yearly income was taxed overall, and calls for tax reform were sparked by the document’s release.

Dan Neidle, a tax specialist, stated: “What cunning strategy did he employ to pay such little tax? Not at all. The majority of the £2.3 million is capital gains, and capital gains on shares are only subject to a 20% tax.”