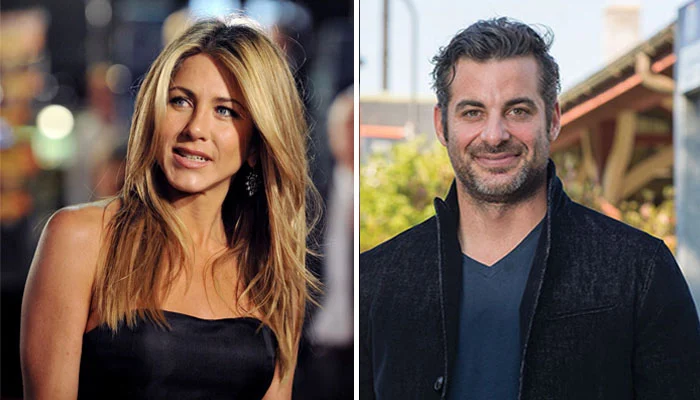

Jennifer Aniston responded to a remark on her relationship with Jim Curtis, a hypnotist.

Entertainment Tonight questioned the Muder Mystery actress about her relationship with the fitness instructor and author during the season 4 premiere of The Morning Show.

The 56-year-old actress, who is keeping quiet about her present relationship, replied, “That’s very nice.”

For those who are unaware, the couple’s sighting aboard a yacht in Mallorca, Spain, in July 2025, ignited dating rumors.