According to the Treasury, if there are good reasons to believe a payment is fraudulent, banks would be permitted to halt transactions for up to 72 hours under the proposed new laws.

The measure, which has the backing of the trade association for the banking sector, comes amid a dispute over the amount that banks and payment companies are required to reimburse victims of the most prevalent kind of payment fraud, known as “authorised push payment fraud.”

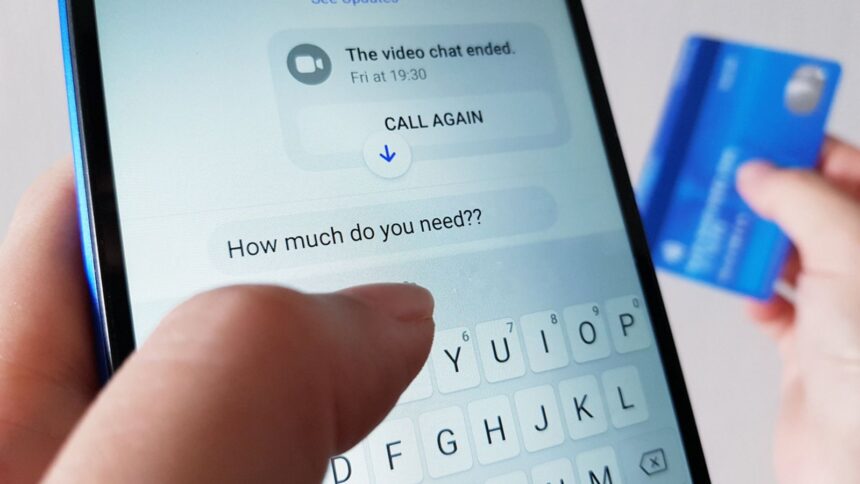

That is the moment when people or companies are duped into transferring funds to an account belonging to a scammer.

Banks prevailed in their lobbying efforts to decrease the cap, which was ultimately set at £85,000 for each claim. It takes effect on Monday.

According to the government, the further authority to postpone payments that has been suggested would enable banks to reduce the approximate £460 million that they lost to fraud last year.

It comprises losses from romance and purchase scams and makes up about one-third of all crime reported in England and Wales.

As per the proposed regulations, a bank would have to notify the consumer of a delay and provide instructions on how to unblock the payment if it discovers evidence of fraudulent activity.