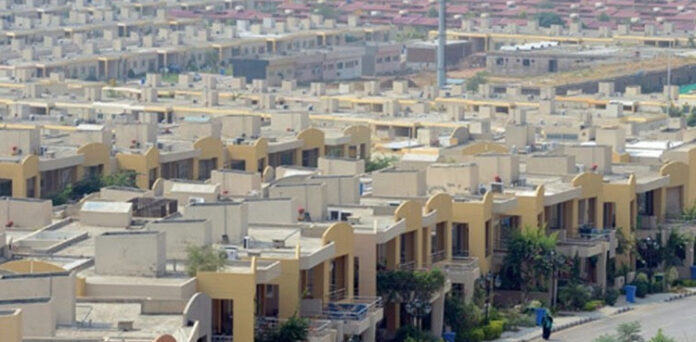

ISLAMABAD According to News, which cited sources, the Pakistani government has decided to increase tax revenue from the real estate industry in the budget 2024–25, which is expected to be presented today.

With an expected expenditure of more over Rs18 trillion, the federal government led by the Pakistan Muslim League-Nawaz (PML-N) will unveil its first growth-oriented budget for the fiscal year 2024–25.

Proposals suggest that Pakistan intended to collect taxes from the real estate industry in three different levels.

Three percent of the purchase price of a property valued at Rs. 50 million will go toward taxes for filers, while six percent will go toward non-filers.

4 percent tax on properties worth up to Rs 100 million would be levied against filers and 12 percent tax on non-filers.

Third-slab non-filers who purchase or sell real estate worth more than Rs 100 million will be subject to a 5 percent tax penalty; otherwise, they will pay a 15 percent tax.

Further reading: Pakistan will unveil its Rs. 18 trillion budget today

Recommendations for real estate

Finance Minister Muhammad Aurangzeb has received the budget 2024–25 suggestions from Pakistan’s real estate specialists.

Ahsan Malik, a real estate expert, claims that throughout the last two years, the industry has seen enormous losses. He issued a warning, saying that increasing real estate taxes will cause more foreign investment to leave Pakistan.

Malik recommended that, in order to represent the true market value of the property in the budget for 2024–2025, the Pakistani government lower DC rates by 33 percent.