Hot News

Pakistan extends ban on Indian aircraft until Aug 23

Measure applies to all Indian-registered aircraft

Another Pakistani airline is ramping up its preparations for flights to the United Kingdom.

Airline plans to operate flights between Islamabad and Manchester from August

Phillips’ injury will prevent him from touring Zimbabwe.

New Zealand coach disappointed over key player’s absence

Pakistan records current account surplus after 14 years

Experts attribute improvement to record-high remittances

Lahore bans motorcyclists without helmet; FIRs to be filed

Traffic officers riding motorcycles without helmets or number plates will face legal action

Hira Mani’s bold saree look gets bittersweet response

Renowned actress garners over 8.5m followers on Instagram

Pakistan stresses zero-tolerance on terrorism, urges global cooperation

FO says Pakistan has comprehensively dismantled terror networks within borders

Yogurt strengthens immunity and promotes digestive health.

Daily intake helps preserve bone density; supports skeletal strength

Flood alert in Punjab, Balochistan: 5 dead; major rivers overflow

Fruit orchards, vegetable gardens inundated, devastating local farmers

Afghan refugees will be blacklisted and the government will not grant Afghan PoR cards: Naqvi

Minister denies any ongoing backdoor diplomacy with India

Editor's Pick

Weather

27°C

New York

overcast clouds

28°

_

26°

79%

7 km/h

Sun

29 °C

Mon

29 °C

You must be a registered user to participate in this chat.

Discover Categories

Top judicial forum forms body to address enforced disappearances

NJPMC directs high courts to establish mechanisms against external influence on judges

Omar Abdullah, IIOJK CM, scales a wall to enter the martyrs’ cemetery despite limitations.

All roads sealed in occupied territory while many political leaders placed under…

Opposition enters final talks to unseat PTI in Khyber Pakhtunkhwa

Kundi, Muqam, and Khattak hold multiple meetings to discuss major power shift…

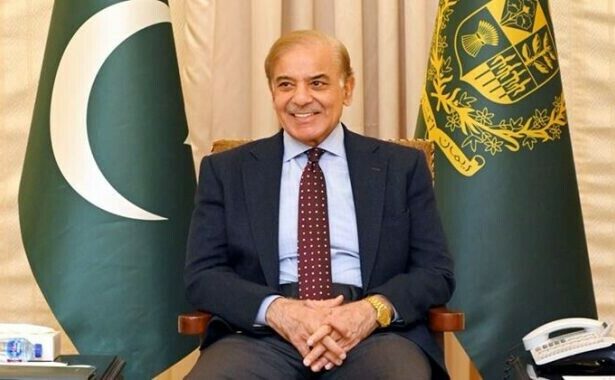

Pakistan adds billions in current account surplus after 22 years

The efforts of the government’s economic team are commendable: PM Shehbaz

Stay Informed, Stay Ahead!

Welcome to Our News Magazine – Your Gateway to Timely Updates. Explore Breaking News, In-Depth Features, and Exclusive Insights. Join Our Community of Knowledge Seekers Today!

Learn More

Sports

Global Coronavirus Cases

Confirmed

65.10M

Death

6.60M

Turkish Foreign Minister Hakan Fidan to visit Pakistan next week

According to diplomatic sources, Turkish Foreign Minister Hakan Fidan is expected to visit Pakistan next week and has significant meetings set for Tuesday. Fidan will meet with Pakistan's top leadership…