Hot News

Hamas seeks ceasefire guarantees as scores more are killed in Gaza

Truce efforts gather pace after US says Israel accepts conditions for ceasefire

Moscow says the deputy head of the Russian navy was killed in the war in Ukraine.

Mikhail Gudkov dies in Ukrainian missile attack in border district of Kursk

Ashura public holidays are announced by the federal government.

July 5 and 6 declared holidays for 9th and 10th Muharram

Pakistani company fits war-affected Gazan girl with prosthetic arm

Bioniks launches humanitarian mission in Gaza with support from Jordanian partner

The foreign minister claims that Iran is dedicated to the nuclear non-proliferation treaty.

Cooperation with IAEA will be channelled through Supreme National Security Council: FM

Heavy monsoon rains expected from July 6 to 10, warns NDMA

NDMA issues nationwide alert for above-normal rainfall

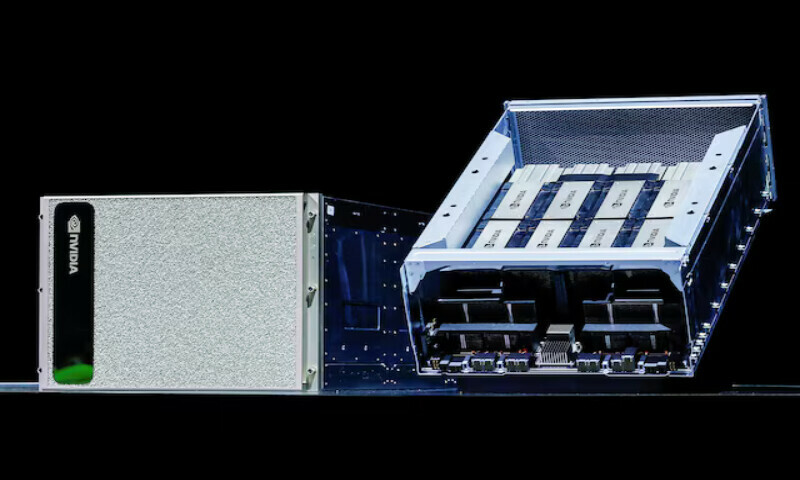

Nvidia set to become world’s most valuable company in history

At $3.915 trillion, Nvidia's market capitalization surpasses Apple's record.

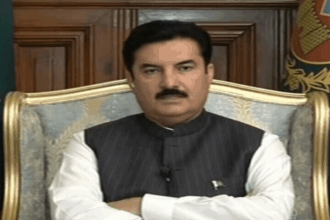

Not working to topple KP govt, says Governor Kundi

Governor says opposition has the right to move no-confidence motion

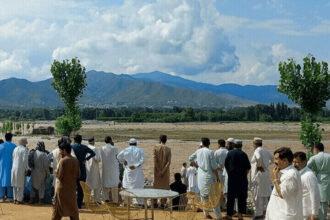

River Swat tragedy probe report blames tourists for the disaster

River flow diverted to facilitate construction activity, claims report

Putin tells Trump he won’t back down from goals in Ukraine

Moscow wants a negotiated end to Ukraine war, Putin tells Trump in phone call

Weather

32°C

New York

scattered clouds

33°

_

30°

61%

3 km/h

You must be a registered user to participate in this chat.

Discover Categories

Stay Informed, Stay Ahead!

Welcome to Our News Magazine – Your Gateway to Timely Updates. Explore Breaking News, In-Depth Features, and Exclusive Insights. Join Our Community of Knowledge Seekers Today!

Learn More

Sports

Global Coronavirus Cases

Confirmed

65.10M

Death

6.60M

NADRA expands mobile biker service in Karachi

There are now eight mobile registration motorbikes, up from three, thanks to a major expansion of the National Database and Registration Authority's (NADRA) biker service for Karachi citizens. The doorstep…